In a world where financial systems rely on the steady flow of taxes to function, the mere thought of everyone simultaneously ceasing to pay taxes is enough to send shivers down the spine of governments, economists, and citizens alike. What if everyone stopped paying taxes? This hypothetical scenario, while unlikely, opens the door to a plethora of consequences and potential outcomes that would have far-reaching implications across society. To understand these ramifications, it’s essential to delve into the history of paying taxes, explore the multifaceted effects of a tax revolt on governments, road infrastructure, electricity, retirement funds, and even the very existence of countries. Additionally, we’ll examine how a country and society could theoretically function without taxes.

A Brief History of Paying Taxes

Taxes have been a fundamental part of human society for centuries. In ancient civilizations, such as Mesopotamia and Egypt, taxes were collected to support the state and its infrastructure. Over the years, taxation has evolved, adapting to the changing needs of societies and governments. Taxation became a crucial instrument for funding public services, supporting social welfare programs, and sustaining national defense.

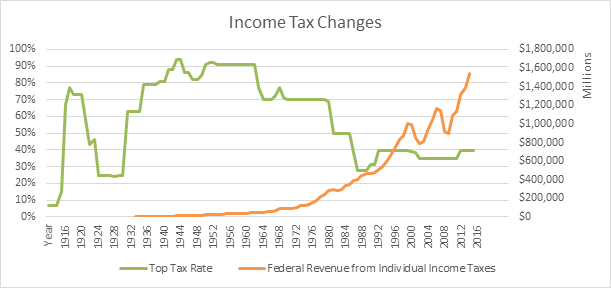

In modern times, taxes have become the primary source of government revenue, supporting essential services like education, healthcare, and public infrastructure. Without taxes, governments would lack the resources required to meet the needs of their citizens, making the prospect of everyone stopping tax payments an alarming one.

So having said that, let’s see potential consequences for governments and society as a whole.

Recommendation: If you'd like to learn how to reduce your taxes we'd greatly recommend following book: "Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your Taxes (Rich Dad Advisors)".

Consequences for Governments

Budget Deficits: The most immediate consequence of a mass tax revolt would be a colossal budget deficit for governments. With their primary revenue source severed, they would be unable to fund public services, pay government employees, or invest in essential projects.

Economic Instability: Governments would be forced to print more money or seek external loans to cover their expenses, leading to hyperinflation and economic instability. This, in turn, could result in a lower standard of living for citizens and increased unemployment.

Crisis of Legitimacy: A government’s ability to govern is directly linked to its capacity to provide essential services and maintain social order. The failure to do so would erode its legitimacy, potentially leading to political turmoil and instability.

Impact on Road Infrastructure

Neglected Maintenance: The funding for road maintenance and construction comes primarily from taxes, especially the gasoline tax. If taxes ceased, roads would deteriorate due to a lack of repairs and upgrades, resulting in unsafe and inefficient transportation.

Congestion and Pollution: As road conditions worsened, congestion and pollution would increase. Traffic jams and accidents would become more common, affecting the quality of life and public health.

Alternative Funding Models: Governments might be compelled to explore alternative funding models for road infrastructure, such as tolls (which are present in many countries) or public-private partnerships. However, these measures could be met with public resistance and implementation challenges.

Electricity and Utilities

Infrastructure Decay: The power grid and utilities infrastructure depend on government funding and regulation. The absence of tax revenue would result in a lack of investment in these sectors, leading to infrastructure decay and blackouts.

Environmental Impact: Reduced investment in clean energy projects and environmental protection would exacerbate climate change and ecological degradation. This could have severe long-term consequences for the planet.

Energy Deregulation: In the absence of government funding, electricity providers may resort to deregulation, leading to erratic pricing and inadequate access to essential services for vulnerable populations.

Note: We’ve described in details what would happen to society without electricity in one of our previous articles so you can check it out if you are interested in all potential consequences.

General Consequences for Society

Public Services Erosion: Without tax funding, public services such as education, healthcare, and social welfare would deteriorate, disproportionately affecting vulnerable populations.

Rising Crime Rates: Increased unemployment, poverty, and reduced access to social services would likely lead to a surge in crime rates, making society less secure.

Social Disparity: The absence of taxes would disproportionately affect lower-income individuals who rely on social programs, while the wealthy might escape the immediate consequences. This would exacerbate income inequality.

Healthcare Crisis: The healthcare system would be severely strained, leading to a potential healthcare crisis with inadequate resources for pandemic management and medical care.

Deteriorating Education: Schools and universities would struggle to function, leading to a poorly educated workforce and a lack of skilled professionals.

The Impact on Retirement Funds

Investment Losses: Retirement funds, such as 401(k)s and pensions, rely on stable financial markets. A crisis triggered by the cessation of tax payments could lead to market instability, potentially causing significant losses for retirees.

Social Security in Jeopardy: Social Security, a vital source of income for many retirees, relies heavily on tax revenues. A significant reduction in tax income would put Social Security benefits at risk, affecting the financial security of millions of seniors.

Interesting fact: During the Roman Republic, a one-time tax called the "centesima rerum venalium" was imposed. It was a sales tax of 1% on goods sold at auction, including slaves. What's remarkable about this tax is that it was one of the earliest forms of consumption tax and is similar in concept to modern-day value-added taxes (VAT) or sales taxes, which are widely used by governments around the world to this day

Would Countries Cease to Exist Without Taxes?

National Disintegration: The cessation of tax payments would undermine a country’s ability to provide basic services, maintain infrastructure, and support its citizens. This could lead to a situation where the government’s authority and control over its territory would erode, potentially resulting in national disintegration.

Sovereignty Challenges: Without the resources to maintain law and order, a government’s sovereignty could be questioned both internally and externally. This could lead to disputes, conflicts, and even potential invasions by neighboring countries.

Emergence of Alternative Structures: In the absence of a functioning government, non-state actors and alternative structures, such as warlords, could rise to power, further destabilizing the nation and fracturing society.

The Potential for Dystopia

Security Challenges: A government unable to fund its military and law enforcement agencies would struggle to maintain national security, potentially leading to conflicts and territorial disputes.

Breakdown of Social Order: A society facing economic collapse, soaring crime rates, and eroded public services may descend into chaos, prompting governments to take authoritarian measures to restore order.

Loss of Technological Advancements: Reduced funding for research and innovation would hinder technological progress, leaving society in a perpetual state of stagnation. However in some cases this might be a good thing. Mostly because, lately it seems that technological advancements are progressing so fast (with AI and Virtual Reality), that some kind of slow down might actually be good for society in the long run.

Environmental Neglect: A government without tax revenue would have little incentive to invest in environmental conservation and protection, worsening climate change and biodiversity loss.

How Could a Country and Society Function Without Taxes?

While the prospect of a society without taxes might seem dire, it is worth exploring how a nation could potentially adapt and function without the conventional tax structures we know today. A tax-free society would require radical shifts in economic models, government structures, and social attitudes. Here’s an analysis of potential adaptations:

- Alternative Revenue Streams: Countries like the UAE and Qatar, which have minimal to no taxes, rely heavily on oil and gas revenues. While not every country has such natural resources, governments could explore other profit-generating assets, like sovereign wealth funds, state-owned enterprises, or real estate investments.

- Voluntary Contributions: In lieu of mandatory taxes, governments could solicit voluntary contributions from citizens and businesses. These contributions could be incentivized through public recognition, influence over government decisions, or other non-monetary rewards.

- Fee-for-Service Models: Governments could adopt a fee-for-service model, wherein citizens pay directly for the services they utilize. For instance, road usage could be charged based on the distance traveled, schools could have tuition fees, and public utilities like water and electricity could be billed based on consumption.

- Decentralized Governance: A significant portion of taxes goes towards maintaining centralized bureaucratic structures. By decentralizing governance and services, costs could be reduced. Local communities might self-organize to manage their affairs, thereby eliminating the need for some centralized administrative expenses.

- Public-Private Partnerships (PPPs): The government could collaborate more closely with the private sector to deliver public services. By allowing businesses to operate and maintain services like transportation, utilities, or even educational institutions, governments might reduce their operational costs while ensuring service delivery through regulatory oversight.

- Digital and Cryptocurrency Integration: The rise of digital currencies and decentralized financial systems offers a new paradigm for managing public finances. Blockchain, the technology behind many cryptocurrencies, can enable transparent, decentralized management of funds for public projects without the need for a centralized taxing authority.

- Community-Driven Initiatives: Local communities could band together to manage and fund shared resources. For example, neighborhood associations might fund and manage parks, local security, or even schools through voluntary contributions or local fundraising.

- Minimalist Government: A tax-free society might necessitate a minimalist government, which focuses only on critical functions like national defense and foreign relations. All other functions could be privatized or managed at a more local level.

- Enhanced Philanthropy: Without taxes, the wealthy might be encouraged (or expected) to contribute more significantly to social causes, infrastructure projects, and other societal needs. Philanthropic efforts could become a more critical pillar of social stability and progress.

- Barter and Trade Systems: Society could revert to or adopt more widespread use of barter and trade systems for services, reducing the need for monetary exchanges and potentially minimizing the scope of taxable transactions.

In essence, while a country and society without taxes would face significant challenges and disruptions, innovative models and adaptations might enable some level of functionality. It would require a radical rethinking of societal structures, governance, and economic systems, with a heightened focus on local communities, decentralized models, and voluntary participation.

However, the balance between freedom from taxation and the desire for efficient, widespread public services would always be a delicate one.

Note: If you enjoyed this article you might also enjoy following articles on topic of “What would happen if”:

- What Would Happen If Everyone Stopped Spending Money?

- What If Everyone Stopped Working?

- What would happen if Moon disappeared?

- What Would Happen If The Moon Exploded

- What Would Happen If Jupiter Disappeared?

- What Would Happen If You Fell Into A Black Hole?

- What Would Happen If The Moon Exploded

- What Would Happen If The Earth Stopped Spinning?

- What If Everyone On Earth Jumped At The Same Time?

- What would happen if water disappeared on Earth?

- What would happen if lying never existed?

- What would happen if gravity suddenly disappeared?

- What would happen if everyone stopped having children?

- What would happen if mosquitoes went extinct?

- …and many more.