Hidden away in offshore accounts around the world sits at least $11.3 trillion. However, many organizations estimate it is actually more than 20 trillion.

That money could end extreme poverty multiple times over.

And this isn’t fiction.

This is the reality of our global financial system, where the wealthy park their fortunes in secretive tax havens while 700 million people struggle to survive on less than $2.15 a day.

Let me tell you quick story about Caroline Muchanga. She runs a small business in Mazabuka, Zambia, selling sugar from her roadside stall. Every day, tax collectors visit her modest operation, demanding their due.

Meanwhile, just kilometers away, Zambia Sugar—a UK-controlled multinational—has shrunk its tax bill to almost nothing through offshore arrangements.

So basically, Caroline pays more in taxes than a corporation generating millions in revenue. And her simple observation cuts to the heart of the matter: “Our profits are not enough. Zambia Sugar should be paying more tax than us.”

Btw, she earns around 4$ a day. If she’s lucky.

And unfortunately, this story repeats across continents. The offshore system has created a parallel universe where different rules apply to different people.

What if even a fraction of that hidden money was redirected to fight poverty? The mathematics suggest a solution easily within reach, if only we had the collective will and commitment to pursue it.

But as we all witness, it’s clear that the commitment is false — and filled with hypocrisy.

Interesting fact: Nearly one in every two dollars of large corporate investment in developing countries now flows through tax havens.

The Paradox of Plenty

This paradox plagues our modern world in the worst way: millions barely surviving while trillions of dollars—or other assets—remain untouched in offshore accounts. It’s more than a paradox — it’s an oxymoron made real.

This huge contrast reveals one of humanity’s greatest moral failures: we possess the resources to end extreme poverty, yet allow it to persist through a system that prioritizes secrecy over survival.

For example, Sub-Saharan Africa, home to just 16% of the world’s population, houses 67% of those living in extreme poverty.

Meanwhile, research based on the Panama Papers reveals that approximately 90% of offshore wealth belongs to people in the top 1% of income distribution, with the top 0.01% holding 50% of all offshore wealth.

The system creates a cruel irony. Those least able to afford taxes bear the heaviest burden while those most capable of contributing escape their obligations entirely.

Interesting fact: The top 0.01% of earners evade about 25% of their taxes through offshore arrangements, compared to only 5% identified by conventional tax audits.

The Hidden Drain on Global Development

Tax havens cost developing countries at least $50 billion annually in lost revenue—roughly equivalent to all foreign aid these nations receive. But this conservative estimate only scratches the surface.

The Tax Justice Network estimates that countries lose $427 billion annually to tax havens—$245 billion from corporate tax abuse and $182 billion from private tax evasion.

Let’s look at couple of examples.

The Malaysian President moved $4.5 billion from a state development fund into offshore accounts with Goldman Sachs’ help.

In Venezuela, a top general watched his country’s economy collapse while stealing public funds through family-controlled offshore investments.

Nicaragua’s promising economy fell apart as its President siphoned millions into offshore banks, stalling infrastructure projects and scaring away investors.

The Democratic Republic of Congo exemplifies this tragedy. Despite enormous mineral wealth—cobalt, copper, diamonds—the country suffers from severe malnutrition and child mortality.

Mining concessions sell for far below market value to middlemen who resell them at massive profits through offshore shell companies.

Five major deals examined by the Africa Progress Panel showed a gap of at least $1.36 billion between market value and actual price paid—nearly double what DRC spends annually on health and education combined.

Yes, bad things are happening everywhere, all the time. Unfortunately, this will likely continue, because human greed cannot be eradicated.

But what we can do is talk about that. And one of best ways to “talk” about this specific issue is through the numbers and math.

Interesting fact: For nearly one-quarter of the world's 82 poorest countries, illicit financial outflows equal ten percent or more of their GDP.

The Mathematics of Misery

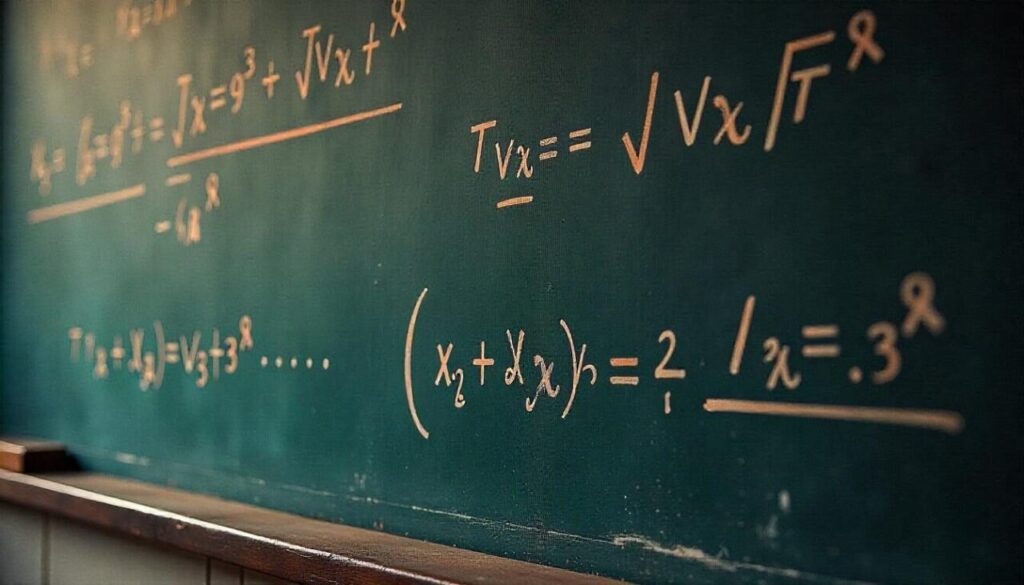

| Poverty Metrics | Amount | Offshore Wealth Metrics | Amount |

| People living on <$2.15/day | 700+ million | Total offshore wealth (% of GDP) | 10% ($11.3 trillion) |

| Annual cost to end extreme poverty | $175 billion | Annual tax revenue lost to havens | $427 billion |

| Cost to end world hunger | $37 billion | Corporate profit shifting | $1.38 trillion |

| Sub-Saharan Africa poverty rate | 67% of global extreme poor | Wealth held by top 0.1% offshore | 80% |

| Countries losing >10% GDP to illicit flows | 25% of world’s poorest | EU tax losses from havens | $154 billion |

| Honduras GDP loss to illicit flows | 21.7% | Developing countries’ annual loss | $50+ billion |

| Zambia GDP loss to illicit flows | 18.1% | Russian wealth held offshore | 60% of GDP |

| Ethiopia GDP loss to illicit flows | 11.2% | Gulf states offshore wealth | 60% of GDP |

| South Sudan poverty rate | 82.3% | Latin America offshore wealth | 60% of GDP |

| Somalia poverty rate | 76.8% | Scandinavian offshore wealth | <5% of GDP |

| Nigeria poverty rate | 70.7% | Swiss offshore banking share | 40-50% of global total |

The scale becomes clearer when you examine specific countries. Honduras loses 21.7% of its GDP to illicit financial flows. Zambia hemorrhages 18.1%. Ethiopia bleeds 11.2%.

These aren’t rounding errors—they represent the difference between functioning public services and institutional collapse.

The $427 billion annual loss equals six times the cost of achieving universal primary education worldwide. It’s almost three times what’s needed for universal primary health coverage.

The $175 billion needed to end extreme poverty globally represents less than half of what countries lose annually to tax havens.

Interesting, huh? Well, many politicians know those exact numbers and yet they don’t do anything about it.

Because most of them are in the system stashing some of their wealth offshore.

Interesting fact: The $427 billion lost annually to tax havens could end extreme poverty 2.4 times over, demonstrating that the resources exist but remain hidden from public use.

How the System Works

Transfer pricing represents the primary method for moving money offshore. The process follows three simple steps that drain billions from developing economies.

A corporation operating in a developing country establishes a subsidiary in a tax haven. The parent company then sells products to this subsidiary at artificially low prices, declaring minimal profits and paying little tax to the developing country’s government.

The tax haven subsidiary sells these same products at market prices, generating huge profits taxed at minimal rates or not at all.

This practice accounts for 60% of capital flight from Africa. Multinational corporations shift $1.38 trillion worth of profit out of countries where it was generated into jurisdictions with extremely low or nonexistent corporate tax rates.

And the complexity here serves a purpose.

Banking secrecy and accounting opacity in places like the British Virgin Islands make it impossible to identify the true beneficiaries of these arrangements. Half of all offshore accounts named in the Panama Papers trace back to this single tax haven.

Money laundering adds another layer to the problem. The offshore world provides safe harbor for proceeds from political corruption, arms dealing, and drug trafficking.

An estimated $55 billion was looted from Nigerian public funds during the Abacha dictatorship—nearly double the country’s current external debt burden.

Interesting fact: The borderline between legal tax avoidance and illegal tax evasion has become increasingly blurred in the offshore system.

The Ultra-Wealthy and Their Hidden Fortunes

The world’s richest individuals have amassed unprecedented wealth, with the top 100 billionaires controlling resources that dwarf entire national economies. According to the 2025 Forbes list, the world now has 3,028 billionaires with a combined net worth of $16.1 trillion. This represents an increase of 247 members and $1.9 trillion compared to 2024.

Elon Musk leads with $342 billion, followed by Mark Zuckerberg at $216 billion and Jeff Bezos at $215 billion.

And the concentration at the top has intensified dramatically—the top 10 richest individuals alone control over $1.8 trillion in wealth.

Research by Gabriel Zucman reveals that approximately 90% of offshore wealth belongs to people in the top 1% of income distribution, with the top 0.01% holding 50% of all offshore wealth. Conservative estimates indicate that the ultra-wealthy hold between 25-40% of their assets offshore.

Applied to the top 100 billionaires, this suggests they collectively maintain $800 billion to $1.3 trillion in offshore accounts—more than the entire GDP of most countries.

The irony becomes apparent when examining public statements from these individuals. Many advocate for poverty reduction and global development while simultaneously using sophisticated offshore structures to minimize their tax contributions.

Tech billionaires frequently position themselves as poverty fighters while using sophisticated tax avoidance schemes. Their foundations receive tax deductions for charitable giving, yet the underlying wealth often remains sheltered from taxation through offshore arrangements.

Interesting fact: The offshore wealth of just the top 100 billionaires could fund the complete elimination of extreme poverty for 4-7 years, yet these same individuals often pay lower effective tax rates than middle-class workers.

Political Hypocrisy

Billionaires (not all of them of course) are not the only ones using tax avoidance schemes.

Politicians are one of the frontrunners. Namely, Pandora Papers exposed a stunning pattern of political hypocrisy, revealing how world leaders who publicly champion poverty reduction simultaneously hide billions in offshore accounts.

The investigation uncovered nearly 12 million financial records detailing over 29,000 offshore accounts belonging to current and former world leaders, government officials, and their associates.

King Abdullah II of Jordan exemplifies this contradiction.

While his country struggles with poverty and relies heavily on foreign aid, the monarch spent $100 million on luxury homes in Malibu, California, through offshore structures.

Jordan’s official poverty rate exceeds 15%, yet its leader maintains huge hidden wealth in American real estate.

Russian President Vladimir Putin’s offshore network reveals perhaps the most elaborate system of hidden wealth. Records link him to secret assets in Monaco, including a $4.1 million apartment purchased by Svetlana Krivonogikh, a woman allegedly tied to Putin who comes from a modest financial background.

This occurred while Putin publicly criticized wealth inequality and promised to address poverty in Russia.

Pakistan’s former Prime Minister Imran Khan built his political career on anti-corruption rhetoric, calling offshore accounts “disgusting” and explaining how money “plundered in the developing world from people already deprived of basic amenities” ends up in western banks.

Yet Khan’s own associates later appeared in the Pandora Papers for their offshore holdings, exposing the gap between public positions and private actions.

Lebanon’s political elite embraced offshore havens while their country faced economic collapse.

Current Prime Minister Najib Mikati, his predecessor Hassan Diab, and central bank governor Riad Salameh all appear in the Pandora Papers for offshore activities. Meanwhile, Lebanese citizens endure hyperinflation, power outages, and banking restrictions.

South Sudan presents the most tragic example. The President himself admitted that $4 billion in foreign aid was “simply put, stolen by former and current officials” and hidden offshore.

This occurred while seven million of the country’s ten million citizens face starvation and 400,000 people died in civil war.

Interesting fact: The 336 high-level politicians identified in the Pandora Papers collectively control more offshore wealth than the annual GDP of most developing countries, yet many of these same leaders regularly call for increased international aid to address poverty.

The Human Cost of Hidden Wealth

Behind every statistic lies human suffering. When governments lose tax revenue to offshore schemes, they cannot fund basic services.

Schools close. Hospitals lack medicine. Roads crumble. Clean water systems fail.

And the correlation between offshore flows and poverty is scary. Higher illicit outflows directly correlate with increased poverty levels, greater income inequality, and lower human development scores.

Countries bleeding money to tax havens struggle to provide their citizens with basic necessities.

The offshore system doesn’t just drain money—it actively worsens inequality.

When corporations and wealthy individuals avoid taxes through offshore arrangements, the burden shifts to ordinary citizens and small businesses like Caroline Muchanga’s sugar stall.

This creates an uneven playing field where size determines tax burden rather than ability to pay. The result is a global economy where those least able to afford taxes bear the heaviest burden while those most capable of contributing escape their obligations.

Now, my utopian mind think that this should not happen anymore. Not with all the resources we have as humanity.

But it is happening constantly, and probably more often then ever.

So, can we do anything about it? What is the solution?

Let’s propose one.

Interesting fact: Developing countries lose an estimated three times more money to tax havens than they receive in foreign aid annually.

The Offshore Poverty Reclamation Framework

A comprehensive solution requires moving beyond fragmentary reforms toward a coordinated global response. The Offshore Poverty Reclamation Framework would establish binding international standards for financial transparency while directing recovered resources toward poverty elimination.

The framework would operate through three core mechanisms.

First, a global treaty would enforce transparency in all financial jurisdictions, requiring public disclosure of beneficial ownership, corporate accounts, and cross-border financial flows. Countries refusing to comply would face automatic sanctions and exclusion from international financial systems.

Second, a graduated tax system would impose annual charges on wealth held in secrecy jurisdictions. Starting at 1% for basic non-compliance and rising to 5% for persistent secrecy, these taxes would make offshore hiding economically unviable while generating substantial revenue for poverty reduction.

Third, recovered funds would flow into a Global Basic Needs Fund managed by independent agencies like the UNDP or World Bank with direct citizen oversight. This fund would prioritize immediate humanitarian needs—food security, clean water, basic healthcare, and primary education—in countries with the highest poverty rates.

The framework would include safeguards against corruption and mismanagement. All fund disbursements would be publicly tracked through blockchain technology.

Local communities would participate directly in project selection and monitoring. Independent auditors would ensure resources reach intended beneficiaries rather than disappearing into government coffers.

The technical infrastructure already exists for expanded transparency. Beneficial ownership registries can identify true controllers of offshore companies. Transfer pricing rules can prevent profit shifting. Anti-money laundering measures can block criminal proceeds.

The challenge only lies in political will and international coordination.

Oh yeah, and in greed also. In BIG greed.

Interesting fact: Blockchain technology could enable real-time public tracking of every dollar from offshore recovery to poverty reduction, creating unprecedented transparency in international development funding.

Breaking the Cycle

But the solution requires global cooperation. Individual countries cannot combat offshore tax avoidance alone. When one nation closes loopholes, money simply flows to more accommodating jurisdictions.

Current transparency initiatives have failed to meaningfully reduce offshore abuse, with very little achieved despite years of international cooperation efforts.

The European Union’s blacklist approach has proven particularly ineffective, targeting jurisdictions responsible for less than 2% of global tax losses while ignoring member states that cause 36% of the problem.

A new framework must address the fundamental incentive structure that makes offshore secrecy profitable.

Implementation would begin with willing countries forming a transparency coalition. As more nations joined, network effects would pressure holdouts to comply or face economic isolation.

But I am thinking overoptimistically here. We all know this will not happen overnight, and if ever.

So what lies ahead?

Interesting fact: If implemented globally, the Offshore Poverty Reclamation Framework could generate enough revenue to end extreme poverty within a decade while creating the most transparent international financial system in human history.

The Path Forward

And so…This isn’t just about numbers. It’s about choices.

It’s about whether we continue to allow a system that rewards secrecy, protects the ultra-wealthy, and penalizes the poor — or whether we demand something better.

We really stand at a crossroads.

On one side: a world where trillions remain hidden, and millions go hungry.

On the other, a world where transparency, fairness, and justice guide economic policy — where money serves humanity, not the other way around.

This is not a technical problem. We already have the math. We have the data. We know exactly where the money is.

What’s missing is the will — the courage — to act.

If even a fraction of those trillions and trillions in offshore accounts were reclaimed and redirected, we could transform the future for hundreds of millions of people. We could build schools instead of shelters, fund hospitals instead of havens, and offer dignity instead of desperation.

But that future won’t come from silence.

It will come from speaking out. From demanding accountability. From pushing for reforms in tax policy, transparency laws, and global financial regulation.

And yes, from sharing stories like Caroline Muchanga’s. Because behind every offshore account lies a face we don’t see.

And behind every number in this piece, there’s a person who didn’t eat today.

The system is broken — not because it has to be, but because powerful people benefit from it staying that way.

So, the question isn’t, can we end extreme poverty.

The question is: will we choose to?

And if we don’t — what kind of world are we really building?

Well, I think we all know the answer.

Interesting fact: Many billionaires' annual charitable giving equals less than the taxes they avoid through offshore arrangements, yet they receive public recognition for philanthropy while their tax avoidance remains hidden from scrutiny.